15 Frugal Lessons from the Great Depression

Make sure to like Living Green and Frugally on Facebook, Shop at Amazon to help support my site and explore our PINTEREST BOARDS for innovative ways you can become self-sufficient.

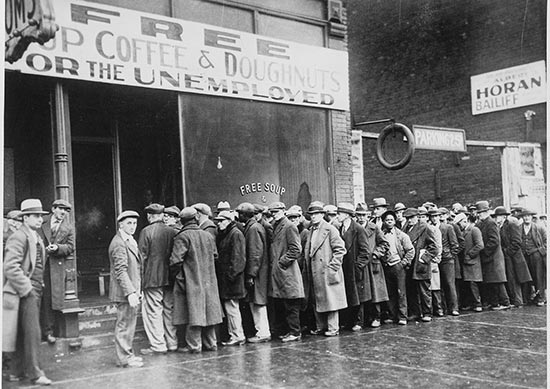

The Great Depression was a period of economic hardship and financial struggle that profoundly affected the lives of millions of Americans during the 1930s. While it was a challenging time, it also gave rise to a wealth of wisdom on how to live frugally and make the most of every penny.

The lessons learned from that era remain relevant today, offering valuable insights on financial resilience and resourcefulness. In this article, we will explore 15 frugal lessons from the Great Depression that can help us conserve our hard-earned cash and achieve financial stability.

1. Live Within Your Means:

One of the most crucial lessons from the Great Depression is the importance of living within your means. Avoid unnecessary debt and prioritize saving over spending.

2. Save for a Rainy Day:

Establish an emergency fund to cover unexpected expenses, just as people did during the Great Depression to protect themselves from economic uncertainties.

3. DIY and Self-Sufficiency:

Learn to do things yourself, from basic home repairs to growing your own food. This self-sufficiency reduces dependence on costly services.

4. Use It Up, Wear It Out, Make It Do, or Do Without:

This Depression-era mantra encourages making the most of what you have and avoiding wastefulness.

5. Cooking from Scratch:

Home-cooked meals are not only healthier but also more budget-friendly than dining out or relying on convenience foods.

6. Frugal Fashion:

Repair and repurpose clothing to extend their lifespan. Thrift stores and hand-me-downs can also be great resources for affordable attire.

7. Thrift and Second-Hand Shopping:

The concept of thrift stores and second-hand shopping became popular during the Great Depression and continues to be an excellent way to find bargains.

8. Bartering and Trading:

During tough times, people often relied on bartering and trading services and goods instead of using cash.

9. Conserve Energy:

Turn off lights, unplug devices, and lower your heating and cooling bills through energy-efficient practices.

10. Reuse and Recycle:

Find creative ways to reuse and recycle items in your household. This not only saves money but also reduces waste.

11. Limit Luxuries:

During the Great Depression, many luxuries were put on hold. Reducing or eliminating unnecessary expenses can help save money for more essential needs.

12. Repurpose and Repair:

Rather than replacing items, consider repairing or repurposing them. This approach extends the life of products and saves money.

13. Grow a Garden:

Growing your own vegetables and herbs can significantly reduce grocery expenses and provide fresh, healthy food.

14. Share Resources:

Pooling resources with family or friends can reduce costs. Carpooling, sharing tools, and bulk-buying are all effective methods.

15. Financial Literacy:

Educate yourself about personal finance. Understanding budgeting, investing, and saving can make a significant difference in your financial stability.

Thoughts

The lessons from the Great Depression are timeless and serve as valuable guides for anyone seeking to be more frugal and financially resilient. By adopting these practices, we can better navigate economic challenges, build a secure future, and enjoy a more fulfilling and less stressful life. Remember that frugality doesn’t mean a life of deprivation, but rather a path to financial independence and the freedom to enjoy life’s pleasures responsibly. The lessons of the Great Depression continue to inspire us to be resourceful, resilient, and financially wise in the face of adversity.

Pin for later!